$1.4 Billion Deal.

Amy Thomson /Melissa Mittelman

August 31, 2016

Genesys Telecommunications Laboratories Inc., the maker of call-center software, has agreed to buy Interactive Intelligence Group Inc. in a deal valued at about $1.4 billion.

Genesys will pay Interactive Intelligence holders $60.50 a share in cash, the companies said in a statement Wednesday. That represents a 36 percent premium to Interactive Intelligence’s price on July 28, before media reported that the company was exploring strategic alternatives, the companies said. It’s 6.8 percent above Tuesday’s closing price.

The deal will give Daly City, California-based Genesys access to Interactive Intelligence’s cloud-based software, which is designed to help call centers improve the customer experience. In recent years, the old 1-800 model has been giving way to services that don’t simply provide support but also follow people as they browse the web, arming companies with data they can use to sell more products and services.

“Customer engagement is the hot topic,” Terry Tillman, a Raymond James analyst in Atlanta, said in a telephone interview. “Whether it’s interacting with your customers in self-service mode on a website or social media, or with the traditional call into a contact center, engaging with your customers and delighting them is as important as ever.”

Tillman also said that Interactive Intelligence’s ongoing shift to a “pure cloud” play could have been difficult if it remained public. By selling itself to Genesys, which is private, the company can sidestep Wall Street skepticism.

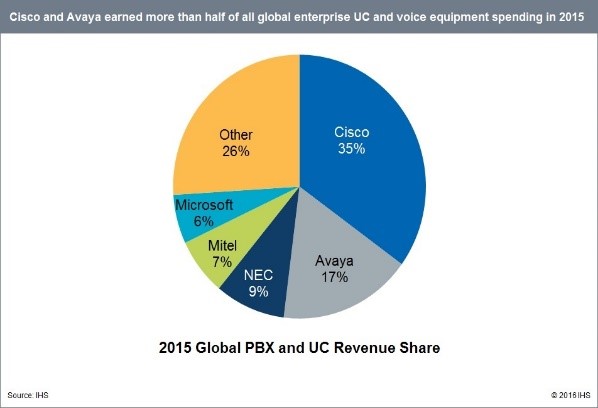

Genesys, which received a $900 million investment last month from private equity firm Hellman & Friedman, is looking to use the recent infusion to expand its business, people familiar with the matter said this month. The company also is considering acquiring Avaya Inc.’s call centers, one of the people said at the time.

The deal, which is expected to close by year-end, is being funded through a combination of cash and debt financing, provided by Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc. and Royal Bank of Canada, the companies said in the statement. Those banks are also serving as financial advisers to Genesys. Union Square Advisors LLC advised Interactive Intelligence.

Avaya, a global leader in business communications systems, soft-ware and services, today announced it has reached one full decade as a Leader in Gartner Magic Quad-rant for Corporate Telephony with the most recent report.

Avaya, a global leader in business communications systems, soft-ware and services, today announced it has reached one full decade as a Leader in Gartner Magic Quad-rant for Corporate Telephony with the most recent report.