By Mark Haranas on July 31, 2015

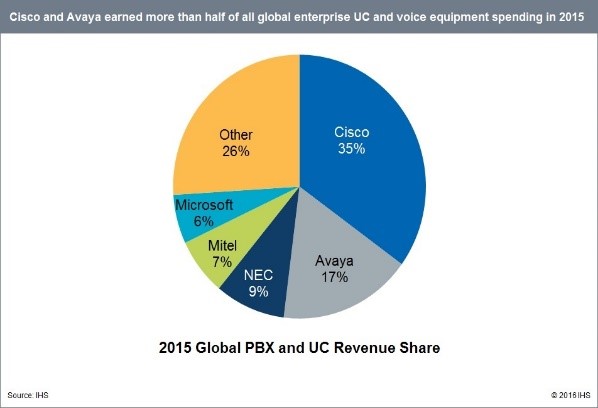

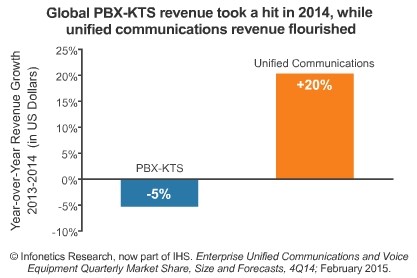

The enterprise telephony market will shrink about 20 percent within the next few years as enterprises move their IT dollars away from premise solutions toward the cloud, although vendors like Cisco and Avaya continue to see growth through on-premise solutions.

The market is expected to decline from an estimated $10 billion in 2015 to $8 billion by 2019, with its peak hitting $16 billion in 2007, according to Dell’Oro analyst Alan Weckel.

“Having premise equipment is less and less important. Those functions are just going to be integrated into other equipment or come from the cloud,” said Weckel in an interview with CRN. “Although on the enterprise side as you get to scale, the ability of having thousands of connections to the cloud for voice really doesn’t make sense. So the enterprise market will have a different transition.”

Dell’Oro is still predicting IP phone growth over the next five years from both PBX vendors like Cisco, Avaya and Alcatel-Lucent Enterprise, as well as from third parties, such as Polycom and Grandstream.

Weckel said enterprises will pick some cloud pieces to use, but, ultimately, the call control will stay premise-based, because for companies with thousands of employees having everything from the cloud “just doesn’t make sense.”

“Cloud makes sense for a lot of SMBs, and the large middle-size companies, but when it gets to thousands of employees, it makes sense to have premise-based solutions,” said Weckel.

“The large vendors, a lot of them are growing through acquisitions and consolidation … If you look at Cisco, they were looking at selling to cloud providers to grow. So using Cisco equipment for the cloud offering, that will be a strategy vendors will use to expand the market — so not selling to the premise but selling to the cloud,” he said.

Analysts said enterprise vendors must create more unique cloud offerings in the telephony market by both selling equipment to support cloud build-outs and by creating stand-alone cloud offerings.

“If you’re a vendor and you don’t have a cloud strategy today, it will be too late,” said Zeus Kerravala, principal analyst at Westminster, Mass.-based ZK Research. “Now it comes down to how aggressively a vendor would be willing to cannibalize its premises-based business in favor of the cloud, how they compensate the channel and how they transition partners.”

“If channel partners do not have a plan in place today for cloud, they will be obsolete in five years,” he said.

Kerravala said ShoreTel has its own cloud offering and cloud partner program that allow the channel to sell its suite of cloud-based VoIP services, while Avaya is enabling its cloud partners to build a cloud rather than offer one directly.

“What’s important is that the vendor plays in the cloud-collaboration market regardless of whether they choose to build, enable others to build, or both,” said Kerravala.

Jamie Wood, executive vice president at Avatel, a Brandon, Fla.-based Avaya partner, said Avaya is ahead of the game with the Avaya Collaborative Cloud open platform solution for partners and customers.

“They provide the options to build, deliver, use, or enhance an organization’s cloud communication services and applications,” said Wood. “[The platform] was designed to support the transition and lives seamlessly alongside the on-premise solutions that organizations retain.”

Wood said the move to cloud communications will be a gradual evolution, and opportunities for solution providers are biggest in the midmarket.

Analysts said solution providers need to expand their level of expertise in cloud or face extinction.

Russ Zielezinski, chief operating officer at Advanced Telecommunications, a ShoreTel and Mitel partner based in Naperville, Ill., said 2015 has been the biggest market shift to the cloud ever.

“It’s been a challenge for us, who were founded as premise-based providers … It has impacted the premise market, and I can say we’ve seen it affect our numbers too,” said Zielezinski. “But for survival, you need to adopt a new cloud-recurring revenue model.”

Zielezinski said solution providers need to become cloud-focused and have the proper amount of technical staff on board to support all the different applications.

Organizations are selecting cloud over premise because companies are more comfortable with using OpEx dollars compared to spending a large sum of money up front for the equipment, according to Weckel.

“So the cloud allows them to pay on a monthly basis, which is just easier from a consumption point of view,” said Weckel.

In addition, cloud solutions are easier for SMBs because they don’t have to overprovision their systems, and it is also typically easier to manage.

“There’s a lot of opportunities there if the VARs and channel expand into adjacent areas around cloud,” said Weckel.

“It’s more than just voice. [Customers] are probably thinking about updating their entire networking, maybe going with a cloud-managed solution there like a Meraki solution for wireless and switching. Maybe they’re thinking about some cloud computing whether it’s Amazon or Rackspace — there’s a lot of opportunity to rewrite applications, write new applications and sort of become the trusted consultant to the customer.”

Every company wants to save money and build stronger relationships between their employees and customers. While some people are uncomfortable talking over a video call, it can be an extremely valuable tool for a small or medium sized company. How many times have you taken a business trip somewhere or attended a conference and said afterwards “the best thing about the trip is I got to meet face to face with a bunch of people I normally deal with over the phone”. In other words, the trip was worth the effort because you were able to build upon a relationship that was, up to that point, only based on audio or written communication. Video may not be as good as an in person meeting but it is the next best thing and it has a WHOLE LOT of benefits (see our blog post next week!)

Every company wants to save money and build stronger relationships between their employees and customers. While some people are uncomfortable talking over a video call, it can be an extremely valuable tool for a small or medium sized company. How many times have you taken a business trip somewhere or attended a conference and said afterwards “the best thing about the trip is I got to meet face to face with a bunch of people I normally deal with over the phone”. In other words, the trip was worth the effort because you were able to build upon a relationship that was, up to that point, only based on audio or written communication. Video may not be as good as an in person meeting but it is the next best thing and it has a WHOLE LOT of benefits (see our blog post next week!)