Mitel to buy Toshiba’s Telecom division

In blog #34 (March ’17) we posted that Toshiba was shutting down its Telecom division headquartered in Irvine CA. At the time of the announcement it was a pure shut down… Toshiba did not try to sell their Telecommunications division but simply decided to shut it down.

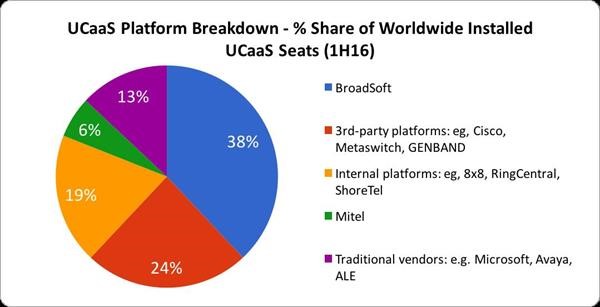

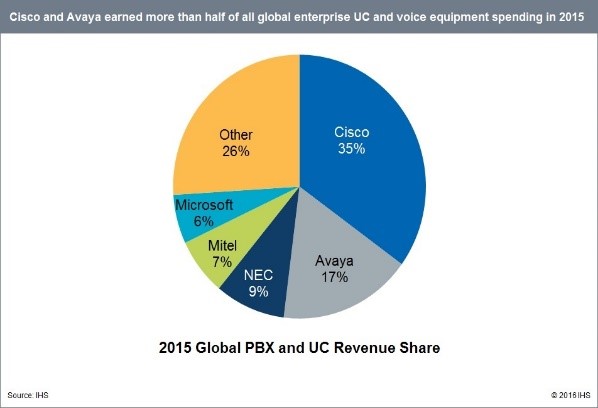

The premise PBX market continues to shrink and as the Cloud telephony business ramps up, there was not enough runway for Toshiba to make the transition. Toshiba sales have been declining for some time and the company has become far less visible and innovative than many of its competitors. Toshiba made an excellent PBX that competed with small business systems from the likes of Panasonic, Mitel, and NEC.

Toshiba had been losing some of its pull in the industry, it was still a shocking decision considering that the company has about a 3% market share in the U.S.

Fast forward to May ’17 and we learn that Mitel is picking up the parts from the Toshiba telecommunications business.

A little about Mitel: They are based in Canada (Ottawa) and have annual revenues of about $850 million.

On May 3rd Mitel announced Q1 financial results for the quarter ended March 31, 2017.

Mitel announced they too are taking proactive cost reduction actions to align its operating expenses with its current business needs. This includes a workforce reduction of approximately 10% expected to be completed between now and the end of the year.

Financial Highlights from Continuing Operations

| Q1 2016 | |||||||

| in millions (except per share data) |

Q1 2017 | Historical Currency |

|||||

| GAAP Revenues | $223.1 | $233.0 | |||||

| GAAP Net Income (Loss) | ($19.7) | ($11.8) | |||||

| Non-GAAP Net Income2 | $10.9 | $10.5 | |||||

| GAAP EPS – basic | ($0.16) | ($0.10) | |||||

Mitel Business Highlights this quarter included:

- Recurring cloud seats grew by 45,000 during the quarter and now stand at 588,000

- Working with a large service provider, Mitel is transitioning 10,000 employees of a second large European-based auto manufacturer from premise to a cloud-based Unified Communications solution.

- A Midwestern US-based furniture retailer with more than 65 locations and an on-line presence selected MiCloud Enterprise and MiCloud Contact Center to connect all locations, centralize answering, and manage their advanced contact center needs including callback in queue and multi-media requirements. The system is all hosted by Mitel.

Mitel, on Thursday May 11th signed a Memorandum of Understanding to transfer assets and support obligations, including existing inventory, from Toshiba to Mitel. The agreement also includes a transition of product and services agreements from Toshiba customers to Mitel.

Mitel expects to close on the Toshiba deal this summer.

Besides transferring their existing inventory, Mitel will also be transferring all of their service and maintenance contracts to Mitel, so that Toshiba customers continue to have support as they move forward.

Terms of the deal were not disclosed.

Mitel made its last acquisition in 2015 with the purchase of cloud-based UC provider Mavenir. The vendor made a bid to buy Polycom last year, although the deal fell through.

Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth

Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth