Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth

Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth

- Creates new $2.5 billion revenue company with scale and differentiated portfolio to expand in evolving enterprise communications market

- Delivers attractive value for Mitel and Polycom’s shareholders with significant operating leverage and synergy opportunities

- Polycom brand to be retained

- Results in a significant reduction in net debt leverage ratio

- Transaction expected to be accretive to Mitel in 2017

OTTAWA and SAN JOSE, Calif., April 15, 2016 (GLOBE NEWSWIRE) — Mitel (Nasdaq:MITL) (TSX:MNW) and Polycom(Nasdaq:PLCM), today announced that they have entered into a definitive merger agreement in which Mitel will acquire all of the outstanding shares of Polycom common stock in a cash and stock transaction valued at approximately $1.96 billion. Under the terms of the agreement, Polycom stockholders will be entitled to $3.12 in cash and 1.31 Mitel common shares for each share of Polycom common stock, or $13.68 based on the closing price of a Mitel common share on April 13, 2016. The transaction represented a 22% premium to Polycom shareholders based on Mitel’s and Polycom’s “unaffected” share prices as of April 5, 2016 and is expected to close in the third quarter of 2016, subject to shareholder and regulatory approvals and other customary closing conditions.

New company with shared vision for seamless communications and collaboration

The combined company will be headquartered in Ottawa, Canada, and will operate under the Mitel name while maintaining Polycom’s strong global brand. Richard McBee, Mitel’s Chief Executive Officer will lead the combined organization. Steve Spooner, Mitel’s Chief Financial Officer, will also continue in that role. Once merged, the combined company will have a global workforce of approximately 7,700 employees.

“Mitel has a simple vision – to provide seamless communications and collaboration to customers. To bring that vision to life we are methodically putting the puzzle pieces in place to provide a seamless customer experience across any device and any environment,” said Mitel CEO Rich McBee. “Polycom is one of the most respected brands in the world and is synonymous with the high quality and innovative conference and video capabilities that are now the norm of everyday collaboration. Together with industry-leading voice communications from Mitel, the combined company will have the talent and technology needed to truly deliver integrated solutions to businesses and service providers across enterprise, mobile and cloud environments.”

“Together, Polycom and Mitel expect to drive meaningful value for our shareholders, customers, partners and employees around the world,” said Peter Leav, President and CEO of Polycom. “We look forward to working closely with the Mitel team to ensure a smooth transition and continued innovation to bring the workplace of the future to our customers.”

Global scale and strategic scope provide key customer benefits

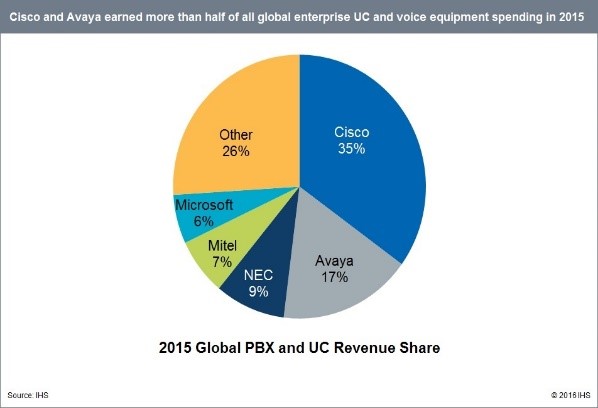

The combined global company will offer customers an integrated technology experience supported by an impressive ecosystem of partners. Key market positions include:

- #1 in business cloud communications (i)

- #1 in IP/PBX extensions in Europe (ii)

- #1 in conference phones (iii)

- #1 in Open SIP sets (iv)

- #2 in video conferencing (v)

- #2 in installed audio (vi)

- Installed customer base in more than 82% of Fortune 500 companies

- Deep product integration with Microsoft solutions

- Mobile deployments in 47 of the world’s top 50 economies

- Combined portfolio of more than 2,100 patents and more than 500 patents pending

- Global presence across five continents with approximately 7,700 employees worldwide

Enhanced platform expected to deliver profitable growth with opportunities for synergies and significant debt deleveraging

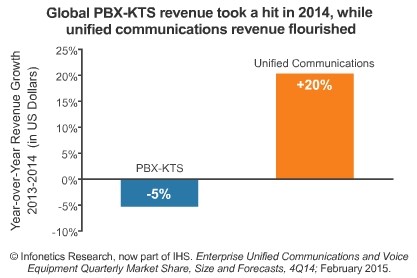

The combined company will have a significantly larger financial platform with the scope, scale and operating leverage needed to strategically expand in an actively evolving market.

Transaction Details

The transaction is expected to close in the third quarter of this year, subject to stockholder approval by Polycom and Mitel, receipt of regulatory approval in certain jurisdictions and other customary closing conditions. Following the closing of the transaction, former Polycom shareholders are expected to hold approximately 60% and current Mitel shareholders are expected to hold approximately 40% of the outstanding Mitel common shares.

Source: Mitel Website

Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth

Combines global technology leaders to create a complete communications and collaboration portfolio and an enhanced ability to deliver profitable growth Avaya, a global leader in business communications systems, soft-ware and services, today announced it has reached one full decade as a Leader in Gartner Magic Quad-rant for Corporate Telephony with the most recent report.

Avaya, a global leader in business communications systems, soft-ware and services, today announced it has reached one full decade as a Leader in Gartner Magic Quad-rant for Corporate Telephony with the most recent report. If you already use Skype to communicate with friends and family at home, you’ll appreciate the power and familiarity of Skype for Business where it’s easy to find and connect with co-workers. And you can use the devices you already have (iPhone, etc.) to reach business contacts through an “enterprise grade”, secure, IT-managed platform. If you’re already using Lync at your office, you’ll recognize all of the features you already use but in a new interface with simplified controls and some good new additions:

If you already use Skype to communicate with friends and family at home, you’ll appreciate the power and familiarity of Skype for Business where it’s easy to find and connect with co-workers. And you can use the devices you already have (iPhone, etc.) to reach business contacts through an “enterprise grade”, secure, IT-managed platform. If you’re already using Lync at your office, you’ll recognize all of the features you already use but in a new interface with simplified controls and some good new additions: