Avaya’s announcement of a “final release” of Nortel CS1000 at version R7.6 appears to have left these customers with one choice: rip and replace.

Enterprises that have Nortel CS1000 platforms and phones were hit hard by the Nortel’s bankruptcy. When Nortel’s telecom related assets were acquired by Avaya and GENBAND, the CS1000 customers became dependent on Avaya for ongoing upgrades and maintenance. Avaya’s announcement of a “final release” of CS1000 at version R7.6 appears to have left these customers with one choice: rip and replace.

Rip and Replace

The rip and replace solution presents several problems for the CS1000 owner. First, there is the expense of a new platform; in most cases new servers will be required. There certainly will be new software, management tools, operational procedures, and re-training of IT staff.

Beyond the core platform, there is also their considerable investment in desk phones. Many enterprises have proprietary Nortel TDM and/or Nortel UNIStim IP phones that are not supported by other vendors. With nearly half the cost of an upgrade tied to desk phones, replacing endpoints can be one of the biggest costs, and, of course, every new phone requires an end user to be retrained. And, since CS1000 customers have felt the pain of being tied to one vendor, standards-based SIP endpoints are in-demand.

The technicians that support the CS1000 and UNIStim phones are also moving on: either retiring or learning new systems. As CS1000 technicians refocus on other platforms, their numbers dwindle, impacting availability. As time goes by, the shortage in expertise and parts drives up maintenance fees.

Users will have to be re-trained. New apps will need to be introduced that essentially replace the CS1000 apps. UNIStim phones will have to be replaced. Moving to Unified Communications will be limited unless the CS1000 is eliminated.

IT’s Goals

Given the expense and complexity of rip and replace it’s no surprise that this is not a CS1000 owner’s first choice. An IT team’s goals for the continued life of the CS1000 are likely to include:

- Extending the life of legacy UNIStim endpoints that can’t be converted to SIP

- Building a true SIP-based solution

- Maintaining feature transparency, thereby saving staff time and retraining users

- Using the enterprise network or Cloud-based service

- Adding Mobility (smart devices)

- Offering UC to a range of endpoints (PC/Mac, tablet, phone)

- Adding Video & Collaboration

- Supporting Advanced Messaging

A GENBAND Solution

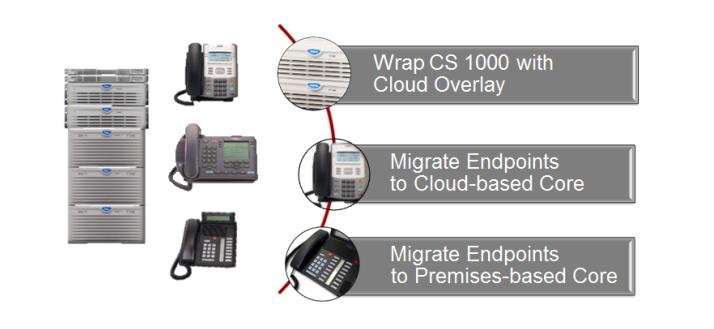

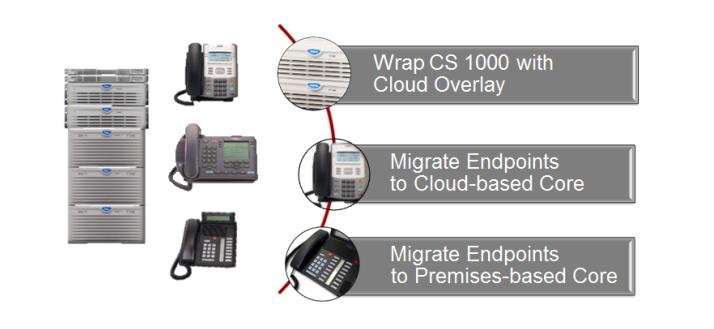

GENBAND has acquired Nortel’s carrier assets. Using their acquired intellectual property theyhave introduced three alternative paths for the CS1000 owner. All three pathways extend the useful life of the CS1000. The pathways not only allow the retention of the CS1000 investment, they also permit the addition of new capabilities for the users.

Three GENBAND Solutions

Wrap the CS1000 with a Cloud Overlay

This solution uses the GENBAND cloud-based service called NUViA™. NUViA™ is an enterprise-class Unified Communications as a Service designed to eliminate the need for premises-based session/call control. It is powered by GENBAND’s EXPERiUS™ solutions which is a platform that ties its heritage to the Nortel MCS platform.

NUViA services can overlay the CS1000 implementation without replacing the existing CS1000 hardware or software. It offers an overlay of UC, video and mobility applications on top of the CS 1000. The enterprise is free to use as little or as much as they want since it is sold on a per seat basis.

Migrate Endpoints to Cloud Based Core

This path expands the NUViA cloud based solution. The enterprise re-registers the UNIStim IP or SIP phones into the cloud-based NUViA system. The DID’s can be moved into SIP or cloud connections or can be maintained on premise gateways registered into NUViA. This allows the enterprise to be always current with the latest features. This solution is also priced on a per seat basis.

Migrate Endpoints to Premises Based Core

This third alternative moves the session/call control to GENBAND’s EXPERiUS™ service. EXPERiUS ties its heritage to the Nortel MCS application server. Given the heritage the feature set will be familiar to CS1000 users. However EXPERiUS is very much a fully virtualized platform with a hardware freedom model where enterprises can select Dell, HP, or IBM servers. The enterprise would re-register UNIStim, IP or SIP phones to the on-premises EXPERiUS servers. Enterprises can then add UC, video and mobility applications.

GENBAND’s Intelligent Messaging Manager integrates with EXPERiUS for voice mail, including emulation of much of the Call Pilot’s telephone interface.

The Benefits

The benefits of the three alternative solutions are:

- Limited or no user training except for new features

- The option to select either CAPEX solution with on-premises or an OPEX solution via the cloud

- Retaining the Nortel phones can save $200 to $500 per user

- Migrating forward with a SIP-based solution

- Deploying a full set of UC features

- No SIP device licenses

Conclusions

The enterprise may select to rip and replace their IP PBX. However, the GENBAND solutions offer a lower impact path for the future. The financial expenses will be lower if the enterprise can continue using its existing CS1000 and UNIStim phone investment.

This is not to say that the GENBAND is the best solution. The enterprise should look at the ROI on both the GENBAND solutions and a rip and replace implementation. It may be that the enterprise is ready to replace the UNIStim phones and the CS1000 is at the end of its ROI life. The GENBAND solutions offer another benchmark for comparison.

Author: Eric Krapf at nojitter