PBX Market and Move to the Cloud

PBX Snapshot

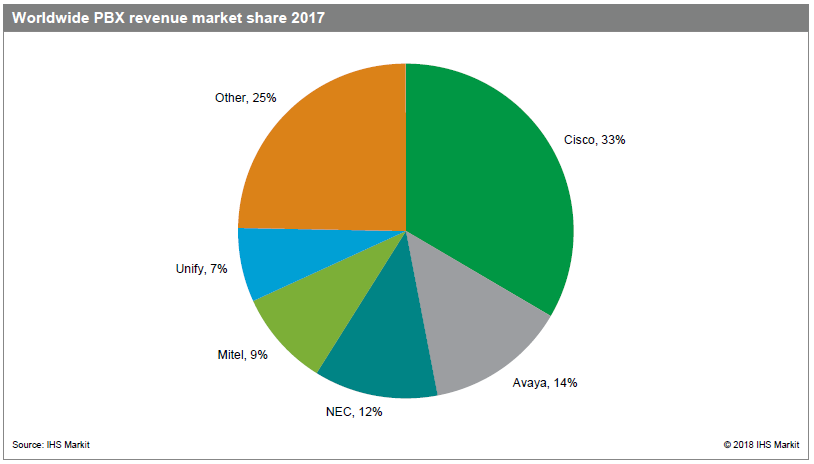

Cisco and Avaya may still hold dominant positions in the PBX market segment, but as enterprises put off spending and move to cloud-based service options, the on-premises PBX segment continues to struggle.

IHS Markit noted in its recent report that a decline in on-premises PBX licenses drove the global market to decline 8% in 2017 from 2016, to $5.7 billion.

Likewise, total PBX lines were down 9% year over year in 2017, with the research firm noting that every segment took a hit.

“Many businesses are holding off on upgrades and new purchases, and the move to cloud services is having an impact,” said Diane Myers, senior research director for VoIP, UC and IMS at IHS Markit, in a new research report. “Underscoring the declines are not just slowing business purchases, but competitive pricing and the move to recurring expense models, which has resulted in market swings.”

Enterprise UC and voice equipment market highlights

- Although enterprise spending is healthy, businesses are giving low priority to telephony upgrades and expansion on the premises side;

- Enterprises continue to migrate to IP—to pure IP PBXs in particular—but the segment remains smaller than hybrid systems; hybrid IP PBXs represented 64 percent of all lines shipped in 2017

- Demand for unified communications (UC) has been erratic over the past four years, but the segment was showing revenue up 5 percent from the prior year;

- On the vendor front, Microsoft led in UC global revenue market share with 67 percent in 2017, trailed by Cisco and Avaya

- For IP phones (IP deskphones and softphones), Cisco was the frontrunner with 35 percent of units shipped in 2017; Avaya was second with 14 percent, followed by Yealink with 10 percent

Cloud Snapshot

Market Research Future published a research report on “Global Cloud for PBX Market Research Report- Forecast 2023”:

The global The Cloud PBX Market is expected to grow at USD ~13.2% of CAGR between 2017 and 2023.

Key Players

The prominent players in the Cloud for PBX Market are – Microsoft Corporation(Skype) (U.S), Nextiva Inc.(U.S), RingCentral Inc.(U.S), , Avaya Inc.(U.S), , Vonage America Inc.(U.S), Cisco system Inc.(U.S), D-Link System Inc. (Taiwan), Mitel Networks Inc. (Canada), NEC Corporation (Japan) and Ribbon/Kandy (U.S) among others

New research from Eastern Management Group values 2017 UCaaS sales at 18% of all PBX sales.

The hosted/cloud PBX market launched about a decade ago on an appeal to cash-strapped small businesses: Get a new PBX for $15 a month, per seat, compared to a new premises-based PBX at $800 for the same seat. That hosted promise has never evaporated. And now the hosted PBX market will close out 2017 having captured 18% of all PBX sales for the year.

Hosted PBX sales have rocketed from 4% of the total PBX market in 2010, to 18% this year. Looking at the numbers, in 2017 new hosted PBX sales were $5 billion. That’s only 3% of the dollar value of all installed PBXs. Today, customers replace PBXs with predictable frequency, which means there’s decades of sales opportunity in front of all hosted UC vendors in just selling PBX replacements.

First American Business Offers Cloud Based UC Services.

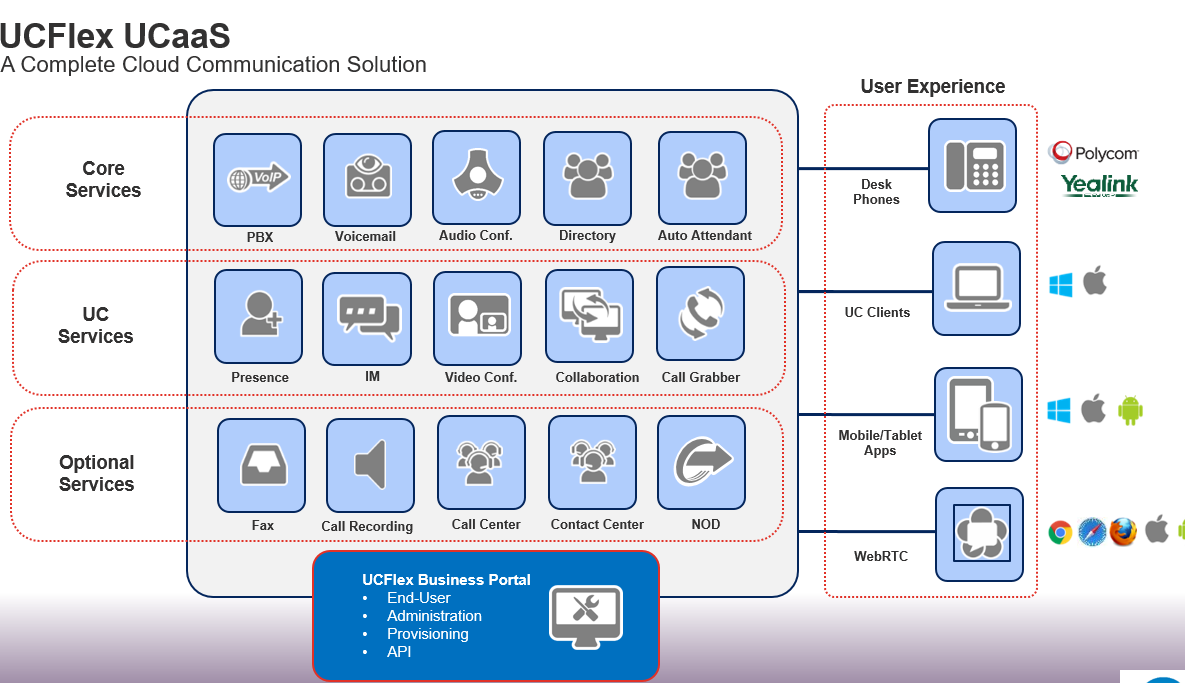

As a gold partner of Ribbon communication First American Business supports legacy PBX systems, on premise IP and Contact center systems and also Cloud Based UCaaS through our UCFlex offer.

We have large enterprise UCaaS (telephony) services using the geo redundant architecture of Ribbon’s Kandy technology solution. We also provide SMB (small enterprise) hosted solutions leveraging our partnership with eMetroTel.