Toshiba Shuts Down Telecom Division

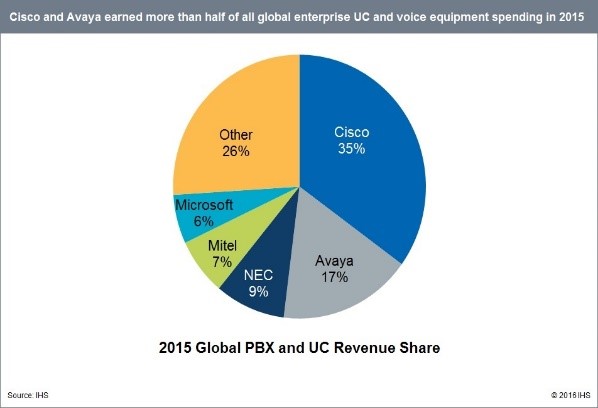

Interesting that Toshiba did not try to sell their Telecommunications division but simply decided to shut it down. As the premise PBX market continues to shrink and as the Cloud telephony business ramps up, maybe there were just no buyers for the smaller players?

Founded in 1975, Toshiba Telecommunication Systems Division (TSD) was a division of Toshiba America Information Systems Inc. (TAIS) – a subsidiary of Toshiba Corporation.

Headquartered in Irvine, California, TSD is a manufacturer of IP business telephone systems, designed for small to medium-sized businesses and larger enterprises with multiple locations. Its ‘Strata CIX IP’ business telephone systems and related applications are sold by a network of Authorized Toshiba Dealers throughout the United States and Latin America.

Dealers were informed via letter on March 21, 2017 that “Toshiba Corporation has deemed it necessary to wind-down its Telecommunication Systems Division (TSD) business starting immediately.” Toshiba has decided to shut down its Telecommunication System Division (TSD) and associated hosting platform services.

According to a memo from Brian Metherell, VP & GM of Toshiba America Information Systems, TSD:

“As part of its continuing global restructuring, Toshiba Corporate has deemed it necessary to wind-down our Telecommunication Systems Division (TSD) business starting immediately.

“Dealers can submit orders through May 22, 2017 subject to inventory availability and purchase order acceptance.”

Toshiba sales have been declining for some time and the company has become far less visible and innovative than many of its competitors. Toshiba made an excellent PBX that competed with small business systems from the likes of Panasonic, Mitel, and NEC.

Toshiba Canada also will be announcing the wind-down of its telecommunications business, and TSD will no longer be selling in Mexico. TSD vowed to support dealers in all warranty and maintenance obligations to customers.

It is a surprise that a once dominate market continues to see contraction.